Financial Options: How to Pay for Your Boot Camp Education

Today it is possible to learn the critical skills for a high-tech career through the help of a boot camp. With a wide range of boot camps on the market, mastering a new skill set has become more accessible than ever before. While boot camps are a great way to jump-start your career, they also tend to come with a financial commitment.

What is the cost of Rice University Boot Camps?

Rice University Boot Camps offer competitively priced tuition costs. Click here to explore pricing.

Before joining a boot camp, you should have a solid understanding of the financing options available to you. This knowledge will help you reach your educational goals without the burden of financial barriers. Below we have outlined several options on how to fund Rice University Boot Camps.

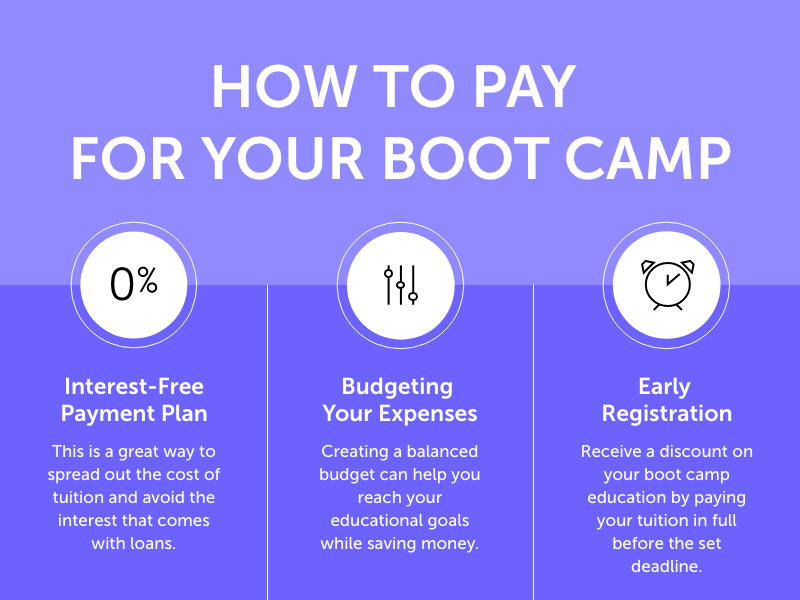

Here’s a quick glance at the top things you should consider as you determine how to pay for your boot camp. Continue reading to find out why these factors are important:

1) Interest-Free Payment Plan

This financial option requires you to pay an initial deposit, then split the rest of your tuition into monthly installments with no additional interest. This payment plan is a great way to spread out the cost of tuition and avoid the interest that comes with loans.

Keep in mind, a smaller deposit means you will be paying larger monthly installments. If you can commit to a more substantial initial deposit, you can expect to make smaller monthly payments. We advise that you review your individual finances or speak with a financial planner before making your decision to see what works best for you.

2) Budgeting Your Expenses

It is important to track your spending and pinpoint where it goes so you can realistically determine what you can cut and create a practical budget for the duration of your boot camp. Start by outlining an ideal, balanced budget and use it to develop a course of action to save money on each budget item.

As you gather all of your expenses, write them down or insert them individually into a spreadsheet. Many budgeting templates can be found online, but you can simply choose to make your own if you prefer. You should then group your expenses into two categories — fixed and variable.

- Fixed Expenses: These expenses are typically the same each month and include costs such as rent, car or mortgage payments and insurance. These are commitments that are typically non-negotiable and often set up with contractual terms. Your boot camp tuition is also a fixed cost that you should factor into your monthly expenses.

- Variable Expenses: These controllable expenses can vary from month to month. They may include groceries, clothing, dining out and entertainment. It is a good idea to closely monitor these expenses and cut back wherever possible.

Keep in mind that you may overspend at times. However, if you consistently review and adjust your plan, you will find it easy to re-allocate spending and keep a balanced budget as you navigate your boot camp.

3) Early Registration

Many boot camps offer an “Early Registration Pricing” incentive. This allows you to take advantage of a discount when tuition is paid in full before the deadline. Early registration also ensures you a guaranteed spot for the next start date, so it’s a good idea to act quickly, as boot camp spaces can fill up fast. Visit our schedule page to see upcoming dates.

Cost by Program

- Coding Part-Time: $12,000

- Coding Full-Time: $12,995

- Data: $12,000

- Cyber: $13,000

- FinTech:

- UX/UI: $13,000

- Digital Marketing: $9,000

Conclusion

When it comes to selecting and enrolling in a boot camp, your focus should be on high-quality education rather than costs. That is why we offer financial options like payment plans to assist you on your journey. Investing in your education is a life-changing decision, and the choices you make now will impact your future. We hope these options will empower you to finance your education in a way that works best for you.

If you have questions about other possible financial options, such as scholarships or loans, please contact our admissions team at or fill out the form below to learn more.

Live Chat

Live Chat